Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A., Economic Indicators

Por um escritor misterioso

Last updated 17 maio 2024

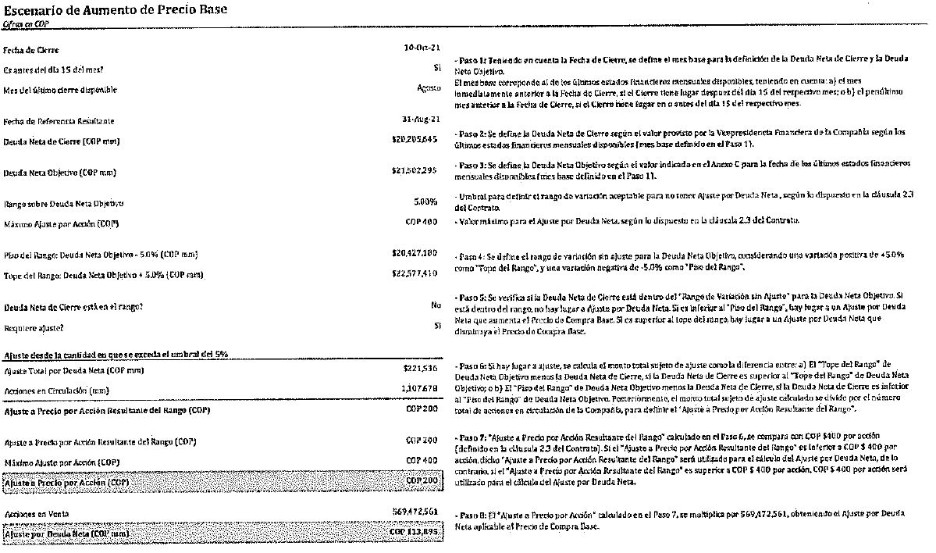

Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data was reported at 0.000 % pa in Jul 2019. This stayed constant from the previous number of 0.000 % pa for Jul 2019. Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data is updated daily, averaging 0.000 % pa from Jan 2012 to 03 Jul 2019, with 1865 observations. The data reached an all-time high of 14.290 % pa in 27 Apr 2013 and a record low of 0.000 % pa in 03 Jul 2019. Brazil Lending Rate: per Annum: Pre-Fixed: Corporate Entities: Vendor: Banco Cedula S.A. data remains active status in CEIC and is reported by Central Bank of Brazil. The data is categorized under Brazil Premium Database’s Interest and Foreign Exchange Rates – Table BR.MB045: Lending Rate: per Annum: by Banks: Pre-Fixed: Corporate Entities: Vendor. Lending Rate: Daily: Interest rates disclosed represent the total cost of the transaction to the client, also including taxes and operating. These rates correspond to the average fees in the period indicated in the tables. There are presented only institutions that had granted during the period determined. In general, institutions practicing different rates within the same type of credit. Thus, the rate charged to a customer may differ from the average. Several factors such as the time and volume of the transaction, as well as the guarantees offered, explain the differences between interest rates. Certain institutions grant allowance of the use of the term overdraft. However, this is not considered in the calculation of rates of this type. It should be noted that the overdraft is a modality that has high interest rates. Thus, its use should be restricted to short periods. If the customer needs resources for a longer period, should find ways to offer lower rates. The Brazilian Central Bank publishes these data with a delay about 20 days with relation to the reference period, thus allowing sufficient time for all Financial Institutions to deliver the relevant information. Interest rates presented in this set of tables correspond to averages weighted by the values of transactions conducted in the five working days specified in each table. These rates represent the average effective cost of loans to customers, consisting of the interest rates actually charged by financial institutions in their lending operations, increased tax burdens and operational incidents on the operations. The interest rates shown are the average of the rates charged in the various operations performed by financial institutions, in each modality. In one discipline, interest rates may differ between customers of the same financial institution. Interest rates vary according to several factors, such as the value and quality of collateral provided in the operation, the proportion of down payment operation, the history and the registration status of each client, the term of the transaction, among others . Institutions with “zero” did not operate on modalities for those periods or did not provide information to the Central Bank of Brazil. The Central Bank of Brazil assumes no responsibility for delay, error or other deficiency of information provided for purposes of calculating average rates presented in this

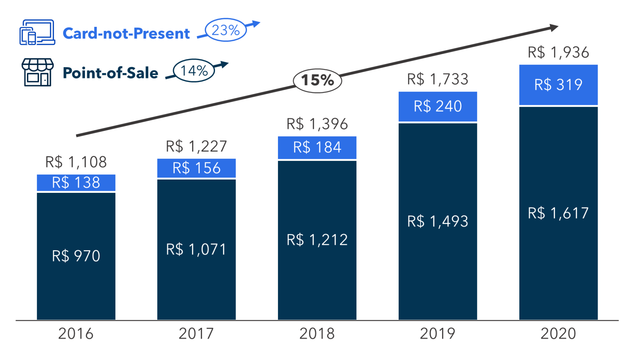

Brazil: Defining Fintech in LatAm

PDF) The Relationship Between Insurance and Entrepreneurship in

Banco Santander 20F 2022 Annual report

Paper Money - Vol. XLII, No. 5 - Whole No. 227 - September

Peru: Third Review Under the Stand-By Arrangement and Request for

Brazil Business credit interest rate, percent, September, 2023

Building the Mexican-Caribbean World (Part I) - Veracruz and the

Brazil, Lending Rate: Central Bank of Brazil

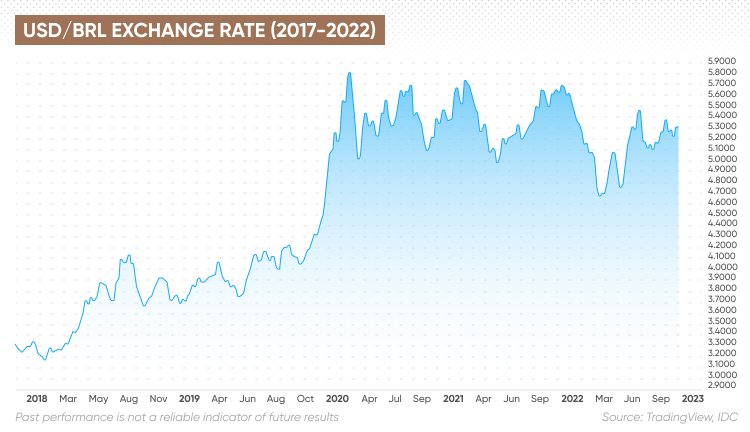

Brazil Real Forecast Will The Brazil Real Get Stronger?

Annual Report 2007 - Santander

Form 20-F ECOPETROL S.A. For: Dec 31

Brazil bank profit in 2022 set to surpass previous year

Converted file

Using Agricultural Bonds For Pre - and Post-Harvest Finance in

Download Report - Independent Evaluation Group - World Bank

Recomendado para você

-

CARUANA DIGITAL - Apps on Google Play17 maio 2024

-

File:Caruana, Jaime (IMF 2008) (frame).jpg - Wikimedia Commons17 maio 2024

File:Caruana, Jaime (IMF 2008) (frame).jpg - Wikimedia Commons17 maio 2024 -

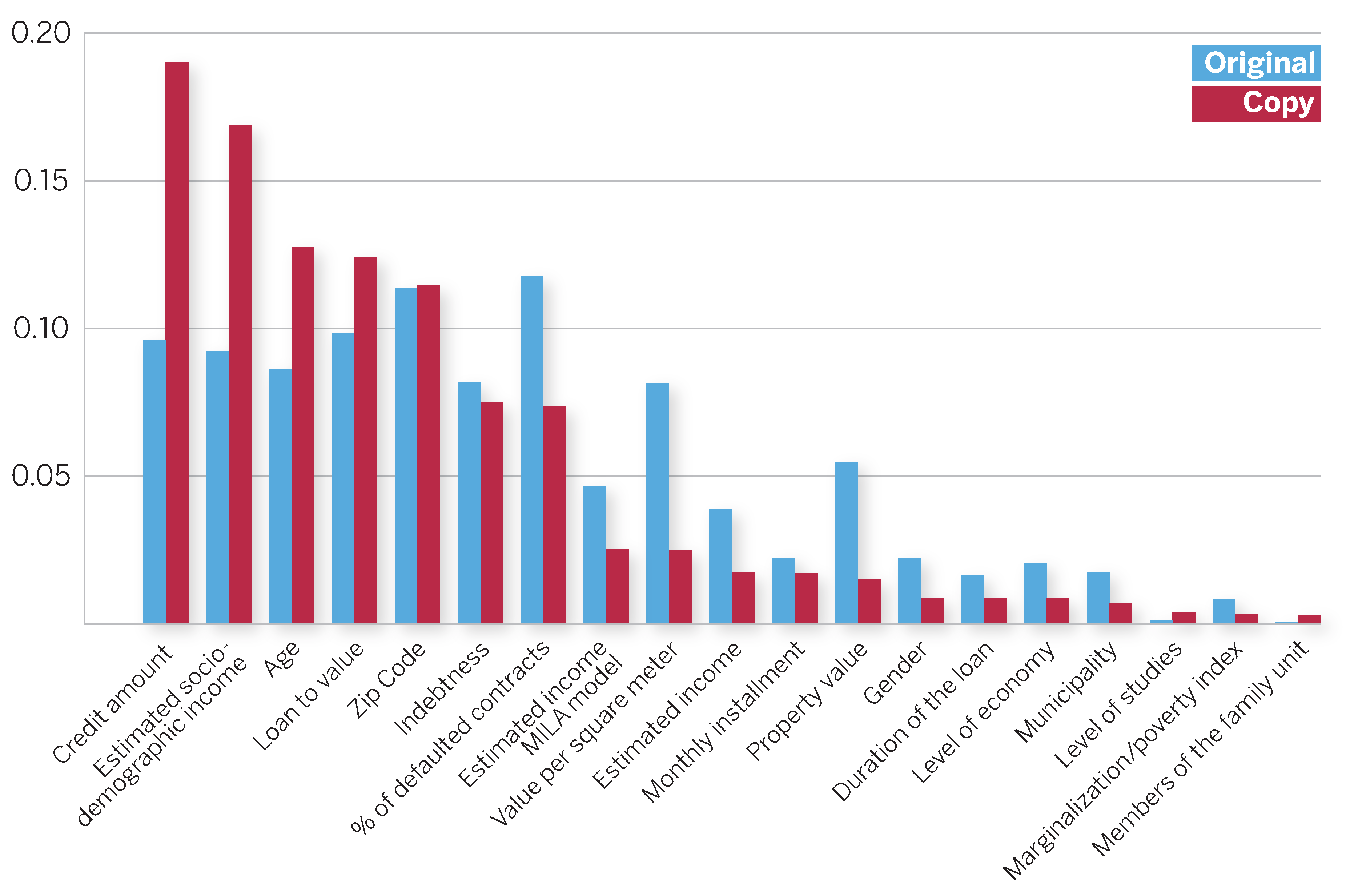

Entropy, Free Full-Text17 maio 2024

Entropy, Free Full-Text17 maio 2024 -

Ricardo Caruana - Go-To-Market Lead, AI/ML - Google17 maio 2024

-

Evicted and Abandoned: The World Bank's Broken Promise to the Poor - ICIJ17 maio 2024

Evicted and Abandoned: The World Bank's Broken Promise to the Poor - ICIJ17 maio 2024 -

From a jumble of secret reports, damning data on big banks and dirty money - ICIJ17 maio 2024

From a jumble of secret reports, damning data on big banks and dirty money - ICIJ17 maio 2024 -

Eurozone Crisis and Banks' Creditworthiness: What is New for Credit Default Swap Spread Determinants? - Alessandra Ortolano, Eliana Angelini, 202217 maio 2024

Eurozone Crisis and Banks' Creditworthiness: What is New for Credit Default Swap Spread Determinants? - Alessandra Ortolano, Eliana Angelini, 202217 maio 2024 -

Full article: The impact of credit shocks on the European labour market17 maio 2024

-

Contents - End the Lie17 maio 2024

Contents - End the Lie17 maio 2024 -

Eventos17 maio 2024

Eventos17 maio 2024

você pode gostar

-

Ash Pokémon 👾 . . Quer desenhar igual os criadores dos desenhos17 maio 2024

Ash Pokémon 👾 . . Quer desenhar igual os criadores dos desenhos17 maio 2024 -

Five Nights At Freddy's – Final Trailer 202317 maio 2024

Five Nights At Freddy's – Final Trailer 202317 maio 2024 -

20th Century Fox 1994 Logo17 maio 2024

20th Century Fox 1994 Logo17 maio 2024 -

O Poder das Cores na sua Marca - Portal Construindo Marcas - Branding Gestão de Marca17 maio 2024

O Poder das Cores na sua Marca - Portal Construindo Marcas - Branding Gestão de Marca17 maio 2024 -

Streamers - Rotten Tomatoes17 maio 2024

Streamers - Rotten Tomatoes17 maio 2024 -

Conflito Holanda-Portugal-Espanha17 maio 2024

Conflito Holanda-Portugal-Espanha17 maio 2024 -

dragon ball z abridged anime dragon ball z gif17 maio 2024

dragon ball z abridged anime dragon ball z gif17 maio 2024 -

SpiRitual – Dude Got Depressed Over Playing Video Games Lyrics17 maio 2024

SpiRitual – Dude Got Depressed Over Playing Video Games Lyrics17 maio 2024 -

Crash Team Rumble registra audiência muito baixa na Twitch17 maio 2024

Crash Team Rumble registra audiência muito baixa na Twitch17 maio 2024 -

dinossauro para pintar (11) - Educarolando - Aprender brincando17 maio 2024

dinossauro para pintar (11) - Educarolando - Aprender brincando17 maio 2024