How An S Corporation Reduces FICA Self-Employment Taxes

Por um escritor misterioso

Last updated 22 maio 2024

How an S corporation can reduce FICA taxes, the criteria for qualifying for FICA-exempt S corporation dividends, and why an S corp may not always be best.

Reduce self-employment taxes with a corporation or LLC

16 Tax Deductions and Benefits for the Self-Employed

Avoid Self Employment Tax - S Corp Election - Reduce SE Tax - WCG CPAs & Advisors

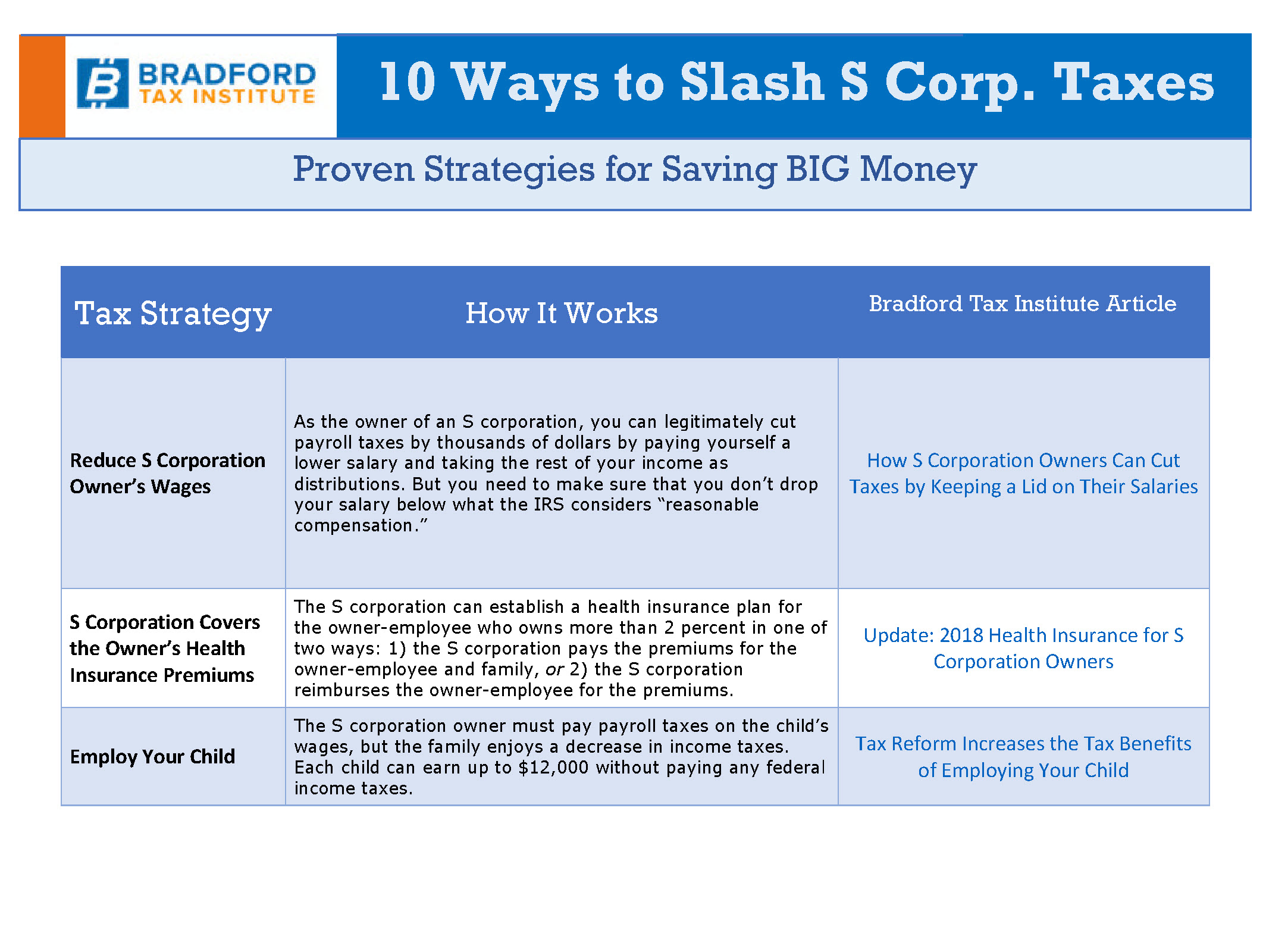

The Practical Guide to S Corporation Taxes - Lifetime Paradigm

How to File Self-Employment Taxes: A Step-by-Step Guide

Optimal choice of entity for the QBI deduction

Using an S corporation to avoid self-employment tax

What Is An S Corp?

S Corporation Tax Benefits, CT Corporation

💰 Should I Take an Owner's Draw or Salary in an S Corp? - Hourly, Inc.

How S Corporations Offer Federal Employment Tax Savings

Understanding Self-Employment Tax

Converting to an S Corporation to Reduce Self-Employment Tax

Home

Recomendado para você

-

:max_bytes(150000):strip_icc()/fica-taxes-and-calculator-on-a-table--874829160-42e252082fb1486dae0bc7cddbcaa16e.jpg) Why Is There a Cap on the FICA Tax?22 maio 2024

Why Is There a Cap on the FICA Tax?22 maio 2024 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime22 maio 2024

What Is FICA on a Paycheck? FICA Tax Explained - Chime22 maio 2024 -

What Are FICA Taxes And Do They Affect Me?, by M. De Oto22 maio 2024

What Are FICA Taxes And Do They Affect Me?, by M. De Oto22 maio 2024 -

What Is FICA Tax? —22 maio 2024

What Is FICA Tax? —22 maio 2024 -

How Do I Get a FICA Tax Refund for F1 Students?22 maio 2024

How Do I Get a FICA Tax Refund for F1 Students?22 maio 2024 -

Vola22 maio 2024

Vola22 maio 2024 -

2017 FICA Tax: What You Need to Know22 maio 2024

2017 FICA Tax: What You Need to Know22 maio 2024 -

2019 US Tax Season in Numbers for Sprintax Customers22 maio 2024

2019 US Tax Season in Numbers for Sprintax Customers22 maio 2024 -

Students on an F1 Visa Don't Have to Pay FICA Taxes —22 maio 2024

Students on an F1 Visa Don't Have to Pay FICA Taxes —22 maio 2024 -

FICA Tax & Who Pays It22 maio 2024

FICA Tax & Who Pays It22 maio 2024

você pode gostar

-

Skip And Loafer Skip To Loafer GIF - Skip and loafer Skip to22 maio 2024

Skip And Loafer Skip To Loafer GIF - Skip and loafer Skip to22 maio 2024 -

Mega Compilation Poppy Playtime Chapter 1 & 2 Sculptures in 202322 maio 2024

Mega Compilation Poppy Playtime Chapter 1 & 2 Sculptures in 202322 maio 2024 -

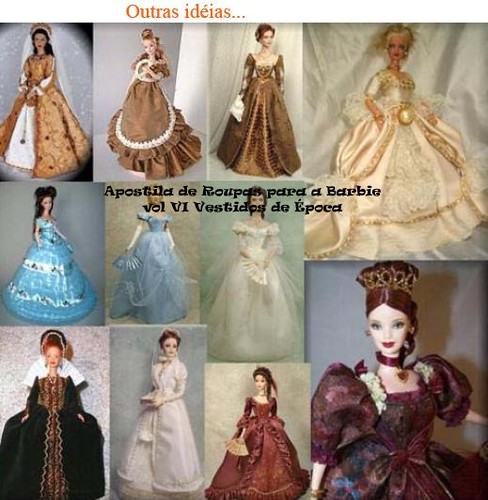

Apostila de Roupas para a Barbie - vol VI, Vestidos de Époc…22 maio 2024

Apostila de Roupas para a Barbie - vol VI, Vestidos de Époc…22 maio 2024 -

23 Brazilian teams are coming to FIFA17! : r/EASportsFC22 maio 2024

23 Brazilian teams are coming to FIFA17! : r/EASportsFC22 maio 2024 -

Slay Past Simple, Simple Past Tense of Slay, Past Participle, V1 V2 V3 Form Of Slay Whe…22 maio 2024

Slay Past Simple, Simple Past Tense of Slay, Past Participle, V1 V2 V3 Form Of Slay Whe…22 maio 2024 -

![eFootball PES 2023 Apk+ Mod For Android Devices (Latest 2023) - [Cracked]](https://gameswiki.net/wp-content/uploads/2022/09/PES-2023-.jpeg) eFootball PES 2023 Apk+ Mod For Android Devices (Latest 2023) - [Cracked]22 maio 2024

eFootball PES 2023 Apk+ Mod For Android Devices (Latest 2023) - [Cracked]22 maio 2024 -

Mako Mermaids: An H2O Adventure22 maio 2024

Mako Mermaids: An H2O Adventure22 maio 2024 -

Haikyuu anime cartaz personagem voleibol menino pintura em tela impressão cuadros arte parede moderna casa decoração da sala de estar frameles22 maio 2024

Haikyuu anime cartaz personagem voleibol menino pintura em tela impressão cuadros arte parede moderna casa decoração da sala de estar frameles22 maio 2024 -

Under-21s Peterborough game postponed - Bristol City FC22 maio 2024

Under-21s Peterborough game postponed - Bristol City FC22 maio 2024 -

Shingeki no Kyojin 4 Quarta temporada será adiada!? Entenda;22 maio 2024

Shingeki no Kyojin 4 Quarta temporada será adiada!? Entenda;22 maio 2024