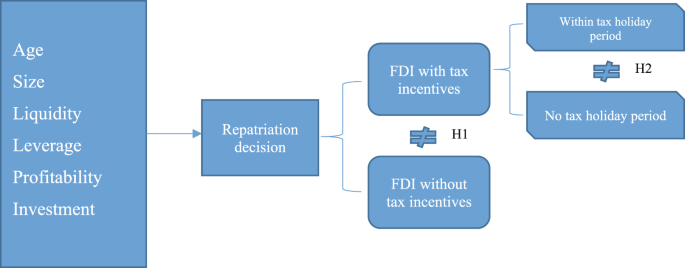

Tax holidays and profit-repatriation rates for FDI firms: the case of the Czech Republic

Por um escritor misterioso

Last updated 19 maio 2024

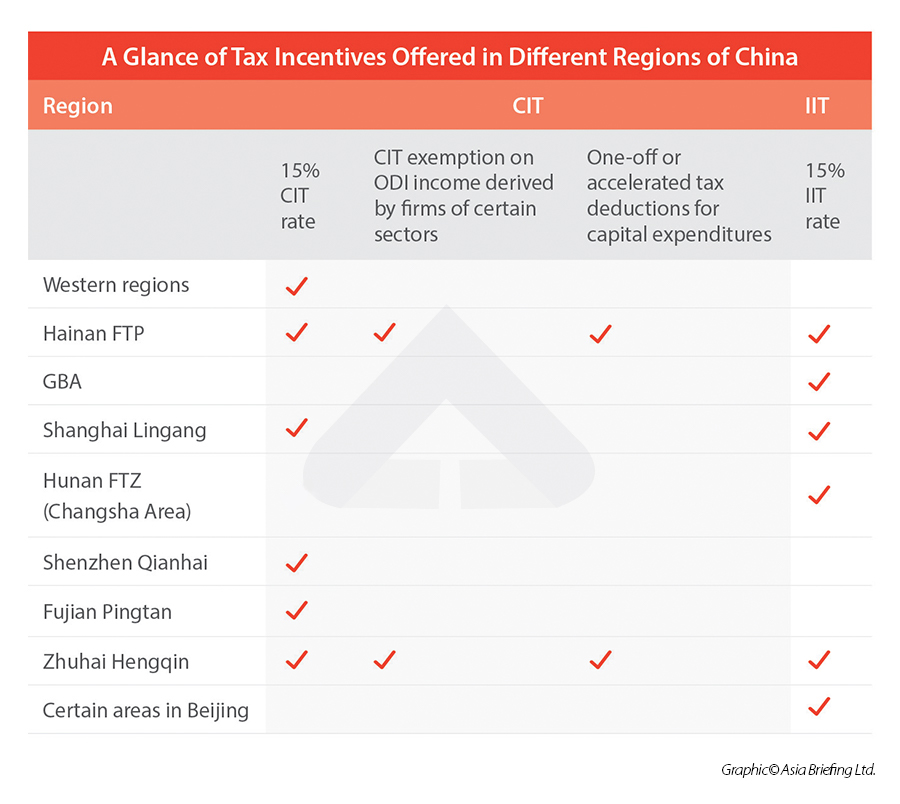

A Comprehensive Summary of Region-wise Tax Incentives in China

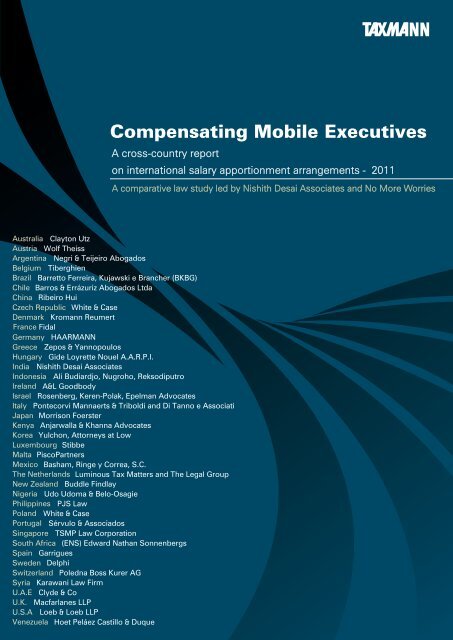

Download the full e-report (pdf) - Kromann Reumert

Foreign Holding Companies and the US Taxation of Foreign Earnings

Profit repatriation rate of FDI firms in the tax incentive period

Czech Republic Foreign Direct Investment

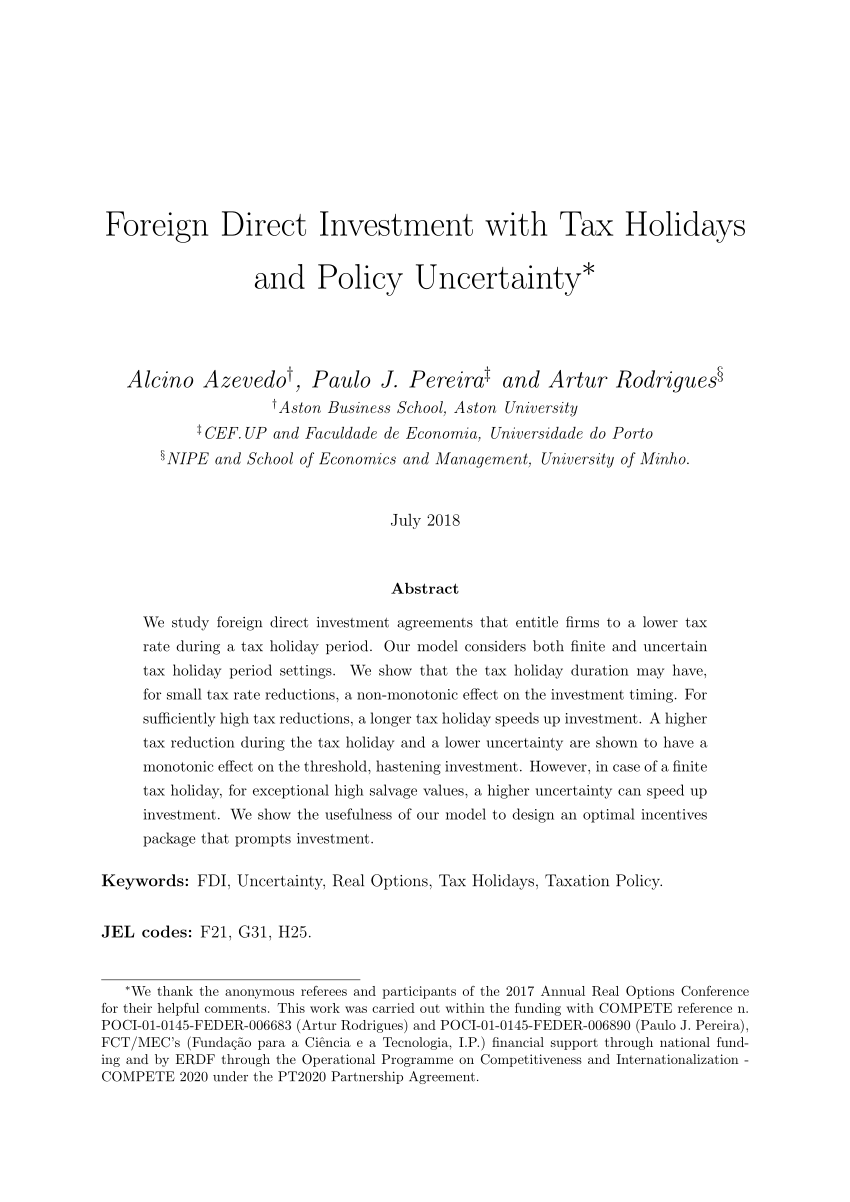

PDF) Foreign Direct Investment with Tax Holidays and Policy

IV Disinflation, Growth, and Foreign Direct Investment in

A Global Perspective on Territorial Taxation

variables, definitions, and data source.

Regression Coefficients, GII Sub-Indices and Legal Variables

Recomendado para você

-

Time Control Contabilidade19 maio 2024

-

God Control – Contabilidade em São Paulo19 maio 2024

God Control – Contabilidade em São Paulo19 maio 2024 -

Digital Leaders Spotlight: Portal Mais Transparência, Portugal19 maio 2024

Digital Leaders Spotlight: Portal Mais Transparência, Portugal19 maio 2024 -

Home - CRM Control19 maio 2024

Home - CRM Control19 maio 2024 -

Peritos em consultoria da J.S. Held são reconhecidos pela Who's Who Legal (WWL)19 maio 2024

Peritos em consultoria da J.S. Held são reconhecidos pela Who's Who Legal (WWL)19 maio 2024 -

Terceirização de Processos de Negócios ou BPO: entenda19 maio 2024

Terceirização de Processos de Negócios ou BPO: entenda19 maio 2024 -

How to Prevent Overutilization in Service Companies?19 maio 2024

How to Prevent Overutilization in Service Companies?19 maio 2024 -

O QUE É TERCEIRIZAÇÃO DO FINANCEIRO?19 maio 2024

O QUE É TERCEIRIZAÇÃO DO FINANCEIRO?19 maio 2024 -

Resource Corner SEEA News and Notes: Issue 1919 maio 2024

Resource Corner SEEA News and Notes: Issue 1919 maio 2024 -

Inventory Management Software - Quickbooks19 maio 2024

Inventory Management Software - Quickbooks19 maio 2024

você pode gostar

-

Bebê Boneca Reborn Realista Corpo Todo Silicone Pode Molhar Menina Maria 55 cm19 maio 2024

Bebê Boneca Reborn Realista Corpo Todo Silicone Pode Molhar Menina Maria 55 cm19 maio 2024 -

Grand Theft Auto V - Xbox 36019 maio 2024

Grand Theft Auto V - Xbox 36019 maio 2024 -

Após propaganda, dono da Netflix dá assinatura vitalícia a Silvio Santos - Últimas Notícias - UOL TV e Famosos19 maio 2024

Após propaganda, dono da Netflix dá assinatura vitalícia a Silvio Santos - Últimas Notícias - UOL TV e Famosos19 maio 2024 -

Camisa retrô Hadjuk split listrada ML - CRO19 maio 2024

Camisa retrô Hadjuk split listrada ML - CRO19 maio 2024 -

Terreno e lotes à venda - Praia do Siqueira, RJ19 maio 2024

Terreno e lotes à venda - Praia do Siqueira, RJ19 maio 2024 -

LNF TV - Gol da Semana19 maio 2024

LNF TV - Gol da Semana19 maio 2024 -

New Features in Ultra Sun and Ultra Moon - Pokemon Sun & Pokemon Moon Guide - IGN19 maio 2024

New Features in Ultra Sun and Ultra Moon - Pokemon Sun & Pokemon Moon Guide - IGN19 maio 2024 -

Thundercats abertura! #thundercats #sbtdesenhos #desenho #bonstempos19 maio 2024

-

The Metaverse: The Next Chapter for the Internet19 maio 2024

The Metaverse: The Next Chapter for the Internet19 maio 2024 -

BALDI'S FINISHED!! The Ending To Baldi's Basics Plus +19 maio 2024

BALDI'S FINISHED!! The Ending To Baldi's Basics Plus +19 maio 2024